Politicians Need To Know Fossil Fuel Money Doesn't Make Good Climate Policy

A guest post by climate strategist Justin Guay. A prior version was published on Twitter.

A guest post by climate strategist Justin Guay. A prior version was published on Twitter.

I don’t know David Victor.

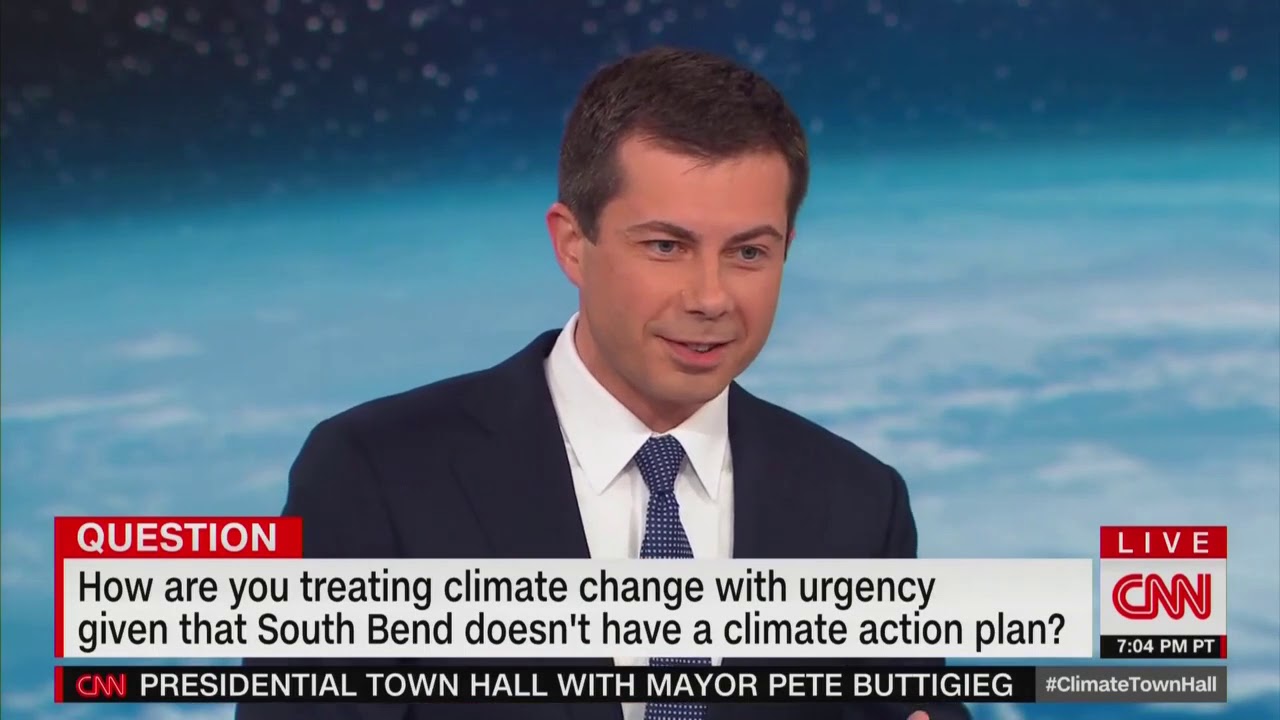

Not in the Trump sense, I literally have never met him. I can’t weigh in on him and don’t want to. But there is an underlying issue swirling around him and the Buttigieg campaign – taking money from those who actively sabotage climate efforts – that needs to be talked about, not hand-waved away.

No one would today, with the hindsight of history, suggest that Tobacco, Asbestos or other universally recognized “bads” should have been at the table designing regulations aimed at eliminating their industries. But fossil fuels, incredibly, are somehow different.

Don’t get me wrong. This is not black and white. There are friends, frenemies (I see you utilities, I see you), and enemies. Companies and actors can and do move amongst the categories. We can’t be ideologues because yesterday’s villain can be tomorrow’s hero. (There’s lots of this in finance.)

But there are, I believe, universal bad guys who will never move because their business model doesn’t allow it. Pure-play coal companies are one, which is why carbon-capture-and-sequestration coalitions should never, ever, allow the likes of Peabody to launder their reputation with their well-intentioned efforts.

And then there’s oil. We do have examples of shifting (Love you, Ørsted). But it’s the exception, not the rule, and it was achieved thanks to hefty state intervention and ownership. The reality is large, publicly traded oil companies today are not friends – they’re enemies and they’re powerful.

So when academics, politicians and other “very serious actors” take their money, they enable an incredibly insidious thing. They launder these companies’ reputations, enable their gaslighting, and generally squander power that is very, very difficult for climate hawks to build.

They do that in part by abstracting climate into a “carbon problem” as though carbon dioxide is not created by specific companies and industries for their own benefit at the expense of our future. Those are arguments the left internalizes, enabling an artificial narrowing of the political horizon.

It’s this, even more than billions spent directly lobbying that I find most troubling. It’s unseen limitations on the ambition of the left that DC refugees know all too well. It’s not “political reality.” It’s artificially generated both-sides-ism brought to you by money.

It’s then made visible by journalists who treat these paid shills as equals as they present counter arguments “in good faith.” That’s not an equal argument focused on what’s in the best interest of the public. That’s an industry fighting to survive at society’s expense.

So let’s be clear. We can not and will not, solve the climate crisis as long as we allow those actively sabotaging action to appear as though they’re not. We will look back and find it ridiculous that this needed to be said.

Fossil-Fuel-Funded Pete Buttigieg Climate Advisor David Victor Opposes Fossil-Fuel Divestment

Pete Buttigieg climate advisor David G. Victor, a political scientist and recipient of millions of dollars from BP and other fossil-fuel companies, begrudged the recent decision of the University of California to divest its endowment from the fossil-fuel industry.

Pete Buttigieg climate advisor David G. Victor, a political scientist and recipient of millions of dollars from BP and other fossil-fuel companies, begrudged the recent decision of the University of California to divest its endowment from the fossil-fuel industry.

”’Divesting from all fossil fuel companies turns the climate problem into something that seems like a simple problem, and in fact it’s the opposite,” Victor told Cal Matters in September, when U of C’s decision was announced. “We should be shareholders in those companies, and we should be active shareholders, to make sure that they’re actually doing it.”

In lieu of divestment, Victor has advocated for drilling for natural gas, “clean coal,” and considering geoengineering in the name of climate action.

Of course, Victor is only one of Buttigieg’s climate advisors.

It is not clear what Buttigieg’s position on the climate divestment movement is. However, Buttigieg, like all of the Democratic candidates for president on the debate stage tonight. has signed the No Fossil Fuel Money pledge, committing to not accept campaign contributions from the fossil-fuel industry.

h/t Dr. Genevieve Guenther

Boston Carbon Risk Forum

The Carbon Risk Forum will bring together city and state government leaders, financial professionals, and leaders of organizations concerned about carbon risk in their investments. We are faced with growing evidence of the risk inherent in fossil fuel investments – it’s time to responsibly move to more sustainable, safer, investments. In the last year, over 30 local governments have moved to divest from fossil fuels, and we hope you will join us for an in-depth examination of the issues and a discussion of what institutions can do to lower their carbon risk. Addressing carbon risk by divesting is financially, morally, and politically prudent. This is a growing movement and we must now map out the path forward for responsibly moving our assets into more sustainable investments. The Forum will provide a unique opportunity for local governments and the institutional financial sector to interface on the components and implications of fossil fuel divestment. The Forum will build off of the successful Seattle Divestment Forum.

Agenda8:00am Breakfast and Registration

8:30am Welcome and Introduction- The Reverend Doctor Robert Massie

- Moderator: Councilor Leland Cheung

- Mark Campanale, Carbon Tracker Initiative

- Mark Lewis, Kepler Cheuvreux

- Moderator: District Attorney Sam Sutter

10:00 – 10:15am Break

10:15 – 12:00pm Divestment as a Response- Stuart Braman, Fossil Free Indexes

- John Fisher, Bloomberg LP

- Bevis Longstreth, Corporate Finance Lawyer and Professor

- Leslie Samuelrich, Green Century Funds

- Moderator: Councilor Seth Yurdin

- Mayor Joseph Curtatone, Somerville MA

- Moderator: Representative Marjorie Decker

- Thomas Kuh, MSCI

- Liz Michaels, Aperio Group

- Moderator: Councilor Michelle Wu

2:30 – 2:45pm Break

2:45 – 3:45pm Divestment Case Study- Donald P. Gould, Pitzer College Board of Trustees

- Eric Becker, Sterling College Board of Trustees

- Dan Curran, President, University of Dayton

- Moderator: Stu Dalheim, Calvert Investments

- Getting Pension Boards to Yes – Stephanie Leighton, Trillium Asset Management

- Divestment or Engagement – Leslie Samuelrich, Green Century Fund

- Maximizing the Political Benefit of Divesting – Mike McGinn, Former Seattle Mayor

- Reinvestment Possibilities – Ken Locklin, IMPAX, Karina Funk, Brown Advisory

- State-level Divestment – Rep. Marjorie Decker, Rep. Aaron Michlewitz

- City-level Divestment – Councilor Seth Yurdin

4:45 – 5:00pm Closing

5:00 – 6:00pm Reception

- Shelley Alpern, Director, Social Research & Shareholder Advocacy, Clean Yield

- Craig Altemose, Executive Director, Better Future Project

- Jim Antal, Conference Minister and President, Massachusetts Conference, United Church of Christ

- Rebecca Bar, Coordinator, Investor Program, Ceres

- Edward Bean, Finance Director, City of Somerville, MA

- Eric Becker, Chief Investment Officer, Clean Yield Asset Management

- James Bennet, Deputy Chief Investment Officer, MainePERS

- Shoshana Blank, Senior Research Fellow, The Sustainable Endowments Institute

- Stuart Braman, Founder and CEO, Fossil Free Indexes

- Dylan Brix, ESG Analyst, Sustainability Group at Loring, Wolcott & Coolidge

- Will Brownsberger, State Senator, MA Senate

- Nick Buonvicino, Student, Merrimack College

- Chris Burns, Deputy Executive Director, Cambridge Retirement System

- Ben Caldecott, Programme Director, Smith School, University of Oxford

- Mark Campanale, Director & Founder, Carbon Tracker, London

- Jay Carmona, Community Divestment Campaign Manager, 350.org

- Michael Carter, Chief Administrative Officer, City of New Haven, CT

- Leland Cheung, Councilor, Cambridge

- Jim Coburn, Senior Manager, Ceres

- Gary Cohen, President, Health Care Without Harm

- Anthony Cortese, Principal, Intentional Endowments Network

- Daniel Curran, President, University of Dayton, Ohio

- Joseph A. Curtatone, Mayor, City of Somerville, MA

- Mark Dailey, Deputy Chief of Staff for Senate Majority Leader Stan Rosenberg, Massachusett Senate

- Stu Dalheim, VP, Shareholder Advocacy, Calvert Investments

- Chris Davis, Director of Investor Programs, Ceres

- Marjorie Decker, State Representative, Cambridge, MA

- Rosamond Delori, Board Chair, World Learning

- Sheila Dormody, Acting Policy Director/Sustainability Director, City of Providence

- Van Du, Special Assistant/Sustainability Adviser, City of Boston – Environment, Energy, and Open Space

- Darcy DuMont, Advocate, 350MA

- Jameson Dunn, Student, Merrimack College Financial Group

- Paul Ellis, Sustainable Investment Consultant, Beacon, NY/Paul Ellis Consulting

- Austin Faison, Director of Operations/Parking Clerk, City of Somerville, MA

- Topher Fearey, Business Development, Brown Advisory

- John Fisher, Bloomberg LP

- Michael Flaherty, Mayor, At-Large Counciler, City of Boston, MA

- Brett Fleishman, Senior Analyst, 350.org

- Emily Flynn, Associate Director, Sustainable Endowments Institute

- Jean Foster, Environmental Action Team Chair, Cambridge

- Tom Francis, Director, Oil & Gas Research, Fossil Free Indexes, LLC

- Sidni Frederick, Co-Coordinator, Divest Harvard

- Karina Funk, Co-Portfolio Manager, Brown Advisory

- Thomas Gainey, Vice President, Pax World

- Eli Gerzon, State Divestment Organizer, Better Future Project

- Donald Gould, President, Gould Asset Management LLC

- Bradford Goz, Director, Fossil Free Indexes

- Vanessa Green, Campaign Director, Divest-Invest Individual

- Shannon Gurek, Vice President, Finance and Administration, South Hadley

- Gilda Gussin, Consultant, Change Producers

- Bob Helmuth, Senior VP – Stakeholder Relations, Pax World Investments LLC

- Spencer Hendersen, Client Service Representative & Research Associate, Aequitas Investment Advisors LLC

- Kathryn Hoffman, Director, Berkeley/ California Student Sustainability Coalition

- Wendy Holding, Trustee, The Sustainability Group

- Robert Hooper, Trustee, State of Vermont VPIC

- James Irwin, Senior Associate, Mayors Innovation Project

- Jenny Isler, Director of Sustainability, Clark University

- Christine Jantz, President & Portfolio Manager, Boston

- Brad Johnson, Reporter, New Republic

- Brett Juliano, ESG Research, MSCI

- Emily Kirkland, Communications Coordinator, Better Future Project

- Emily Koo, Deputy Director of Policy, City of Providence

- Thomas Kuh, PhD, Executive Director, MSCI ESG Indexes

- Laura Kunkemueller, Investment Consultant, Mercer

- Natasha Lamb, Director, Equity Research & Shareholder Engagement, Arjuna Capital

- Alex Lamb, Senior Consultant, EY

- Stephanie Leighton, Partner & Portfolio Manager, Trillium Asset Management

- Mark Lewis, Senior Analyst, Kepler-Cheuvreux

- Jason Lewis, State Senate, Middlesex, MA

- Kenneth Locklin, Senior Portfolio Advisor, Impax

- Bevis Longstreth, Former Commissioner, SEC, New York City

- Tim MacDonald, Senior Fellow, Capital Institute

- James Maguire, Director, Grants Management & Accounting, Merck Family Fund

- Robert Massie, Advisor, 350.org

- Jessica Matthews, Managing Director, Cambridge Associates

- Chloe Maxmin, Student, Divest Harvard

- Michael McDonald, Reporter, Bloomberg News

- Michael McGinn, Former Mayor, Seattle WA

- Robert Melton, Vice President, MSCI

- Liz Michaels, Director, ESG/SRI; Chief of Staff, Aperio Group

- James Michel, Trustee, First Church in Jamaica Plain

- Aaron Michlewitz, State Representative, House of Representatives

- Amy Miller, City and State Divestment Campaigner, 350.org

- Andy Mims, Trustee, Boston/The Sustainability Group

- James Monagle, City Auditor, City of Cambridge, MA

- Richard Mott, Environment Director, Wallace Global Fund

- Nelson Murphy, Director, Investor Development, United Church Funds

- Jaclyn Olsen, Assistant Director, Harvard University Office for Sustainability

- Mark Orlowski, Executive Director, Sustainable Endowments Institute

- Mark Peters, Principal, Federal Street Advisors

- Mark Quercio, Investment Professional, NorthPointe Wealth Management

- Susan Redlich, Divestment Team Member, 350MA.org

- Kelly Regan, Investment Consultant, NEPC

- Satya Rhodes-Conway, Managing Director, Mayors Innovation Project

- Dave Rogers, State Representative, Massachusetts House of Representatives

- Leslie Samuelrich, President, Green Century Capital Management

- Charles Sandmel, Portfolio Manager, First Affirmative Financial Network

- Sam Sutter, District Attorney, Bristol County

- Andrew Thompson, Client Relationship Manager, Boston Common Asset Management

- Leah Turino, Environmental, Social, and Governance (ESG) Associate, Boston Common Asset Management

- David Unger, Journalist, The Christian Science Monitor

- Austin Williams, Environmental Caucus Chair, College Democrats of Massachusetts

- Emily Williams, Communications Intern, Better Future Project

- Candace Williams, Legislative Aide to Senator Michael Barrett, MA State Senate

- Canyon Woodward, Student Coordinator, Divest Harvard

- Michelle Wu, City Councilor At-Large, City of Boston, MA

- Seth Yurdin, Majority Leader, Providence City Council

- Giovanni Zinn, Project Manager, City of New Haven, CT

- Andrew Zucker, Senior Research Scientist, Concord MA / The Concord Consortium

Harvard President Drew Faust Announces Initial Steps Towards Carbon Divestment

In a letter to the Harvard University community, president Drew Faust has announced the globally influential institution’s endowment will commit to sustainable investment practices. Harvard University has become the first educational institution to become a signatory to the United Nations’ Principles for Responsible Investment, and to the Carbon Disclosure Project’s climate program.

After increasing pressure from students, faculty, and alumni in support of the climate divestment movement, Faust reversed her previous stance opposing action, recognizing that the “special obligation and accountability to the future” held by Harvard requires action not just in research and policy but also “as a long-term investor.”

Harvard’s actions should not be interpreted as explicit acceptance of the principle that sustainable investment requires divestment from the fossil-fuel industry. However, looking at the “systemic risks presented by or created by companies” is part of the Principles of Responsible of Investment. Faust has now applied that assessment to the fossil-fuel industry, saying that the Harvard community “must devote ourselves to enabling and accelerating that transition” — “to chart the path from societies and economies fundamentally dependent on fossil fuels to a system of sustainable and renewable energy.”

The full text of the announcement letter is below:

Dear Members of the Harvard Community,Worldwide scientific consensus has clearly established that climate change poses a serious threat to our future—and increasingly to our present. Universities like ours have produced much of the research supporting that consensus, as well as many of the emerging ideas helping us to begin confronting that challenge. Yet we have far more work ahead to chart the path from societies and economies fundamentally dependent on fossil fuels to a system of sustainable and renewable energy. We must devote ourselves to enabling and accelerating that transition—by developing the technologies, policies and practices that would make it possible—if we are to mitigate the damage that rising greenhouse gas levels are inflicting on the planet.

Harvard has a vital leadership role to play in this work. As a university, it has a special obligation and accountability to the future, to the long view needed to anticipate and alter the trajectory and impact of climate change. Harvard also possesses the wide range of capacities across fields and disciplines that must be mobilized and conjoined in order to create effective solutions. Ideas, innovation, discovery and rigorous independent thought will serve as indispensable elements in combating the climate threat; these are the special province of universities.

Already we support research at the vanguard of energy and climate science—from new technologies for energy storage, to solar ovens to reduce pollution in the developing world, to an “artificial leaf” that mimics photosynthesis to produce renewable fuel, to give just three examples. Our faculty are deeply engaged as well in informing the development of law and policy to advance sustainability and to address the hazards of climate change worldwide, from advancing climate agreements, to fashioning legal frameworks for regulating shale extraction, to designing models for sustainable businesses. The Harvard University Center for the Environment engages more than 200 faculty sharing their insights and their commitment to these urgent issues. And our educational programs, with some 250 courses across the University focusing on aspects of environmental sustainability, will prepare leaders with the insight and foresight to safeguard our environment in the years and decades to come.

Harvard has the opportunity and the responsibility to help create the path to a sustainable future. We can and must galvanize the deep commitment of students, faculty, staff and alumni to work together to move us closer to a world founded on renewable energy. Today I would like to highlight three areas in which we are focusing special attention as part of our obligation to our planet and our collective future.

First, and at the heart of our mission as a university, is research. Our research across Harvard—in climate science, engineering, law, public health, policy, design and business—has an unparalleled capacity to accelerate the progression from nonrenewable to renewable sources of energy. The Harvard Campaign has identified energy and environment as a priority, and we have already raised $120 million to support activities in this area. As part of this broader campaign focus, I intend to catalyze the aspects of that research specifically focused on shaping and accelerating the transition to a sustainable energy system.

I challenge our talented and dedicated faculty and students to identify how their efforts can propel societies and individuals along this path. And I challenge our alumni and friends to assist me in raising $20 million for a fund that will seed and spur innovative approaches to confronting climate change, as an element of our broader campaign efforts in energy and environment. To launch this new Climate Change Solutions Fund, I will immediately make available $1 million in grants to be allocated at the outset of the coming academic year. (Please see here for further information on this fund and the application process.)

Second, Harvard must model an institutional pathway toward a more sustainable future. We have the opportunity to serve as a living laboratory for strategies and initiatives that reduce energy consumption and greenhouse gas (GHG) emissions in the ways we live and work. In 2008, the University set an ambitious goal of achieving a 30 percent reduction in our GHG emissions from our 2006 baseline by 2016, including growth. Thanks to the leadership of our GHG reduction executive committee and our Office for Sustainability, and the dedicated efforts of individuals across Harvard, we have so far achieved a reduction of 21 percent, when we include the effects of growth and renovation in our physical plant, and 31 percent, when we do not. (For details on how we have joined as One Harvard to accomplish this, please see here.)

As we recognize our remarkable progress, we must also recommit to the work ahead. I have accepted the recommendations of the task force empaneled to review Harvard’s progress toward its GHG reduction goal. Co-chaired by Jeremy Bloxham, Dean of Science in the Faculty of Arts and Sciences; Robert S. Kaplan, Professor of Management Practice at Harvard Business School; and Katie Lapp, Executive Vice President, the task force has proposed, and I have agreed, to the following:

- We will continue to explore and exhaust all on-campus efficiency and reduction projects to the maximum extent possible.

- We recognize, as we did when we set our goal in 2008, that even after our aggressive on-campus efficiency efforts, a gap will likely remain to achieve our goal of 30 percent reduction (including growth) by 2016, requiring us to explore complementary mechanisms, including offsets. We will establish an advisory group of faculty, students and staff to evaluate and recommend complementary off-campus emissions reduction options that are additive and real.

- We will create a sustainability committee led by senior faculty to shape the next generation of sustainability solutions and strategy on our campus.

Third, in addition to our academic work and our greenhouse gas reduction efforts, Harvard has a role to play as a long-term investor. Last fall, I wrote on behalf of the Corporation to affirm our judgment that divestment from the fossil fuel industry would not be wise or effective as a means for the University to advance progress towards addressing climate change. I also noted that, with the arrival of a first-ever vice president for sustainable investing at Harvard Management Company, we would strengthen our approach to how we consider material environmental, social and governance factors as we seek robust investment returns to support our academic mission.

Today I am pleased to report that we have decided to become a signatory to two organizations internationally recognized as leaders in developing best-practice guidelines for investors and in driving corporate disclosure to inform and promote sustainable investment.

Specifically, Harvard’s endowment will become a signatory to the United Nations-supported Principles for Responsible Investment (PRI). The PRI joins together a network of international investors working to implement a set of voluntary principles that provide a framework for integrating environmental, social and governance factors into investment analysis and ownership practices aligned with investors’ fiduciary duties. Harvard Management Company will manage Harvard’s endowment consistent with these principles.

In addition, we will become a signatory to the Carbon Disclosure Project’s (CDP) climate change program. The CDP is an international nonprofit organization that works with investors to request that portfolio companies account for and disclose information on greenhouse gas emissions, energy use and carbon risks associated with their business activities in order to increase transparency and encourage action.

Both these significant steps underscore our growing efforts to consider environmental, social and governance issues among the many factors that inform our investment decision-making, with a paramount concern for how the endowment can best support the academic aspirations and educational opportunities that define our distinctive purposes as a university.

As we take these steps forward—supporting innovative research focused on climate change solutions, reducing our own carbon footprint, advancing our commitments as a long-term investor—we should also step back and see the bigger picture. In the broad domain of energy and environment, as in many other fields, people at Harvard make extraordinary contributions, in myriad ways, to generating the knowledge, ideas and tools that in time can help society’s most complex and intractable problems seem amenable to effective solutions. Ultimately, Harvard will contribute to confronting climate change not through presidential pronouncements, and not through a sudden burst of eureka moments, but through the steadfast, unrelenting commitment of faculty, students, staff and alumni who train their minds on hard questions, combine their imagination with rigorous analysis and convert their insights into effective action. Whatever your own particular academic interests, I hope you will take the time to learn more about our collective efforts in energy and environment, highlighted here and elsewhere. More than that, whatever part of Harvard you inhabit, I hope you will count yourself among the thousands of people across the University who increasingly embrace a concern for environmental sustainability as an integral part of our academic work, our institutional practices and our daily lives.

Sincerely,

Drew Faust

Christian Parenti's Un-Christian Attack on the 350.org Fossil Divestment Campaign

In a scathing critique at the Huffington Post, Nation editor Christian Parenti blasts the 350.org fossil-industry divestment campaign, Fossil Free, as merely “symbolic” and flawed by “crucial weaknesses”—namely, that even if colleges divest from fossil fuel investments, the fossil fuel industry will still be very rich and powerful.

It is not clear why Parenti, a colleague of Naomi Klein, one of the strategists behind the divestment campaign, took the unusual step of taking his criticisms in public, after the campaign has been launched and divestment efforts begun on 146 campuses across the nation.

In an email to Hill Heat, a prominent climate activist with national influence responded to Parenti’s critique:

This manages to be smug and naïve at the same time. And totally ahistoric. His basic conclusion is “government should do its job.” Super.Why isn’t that happening now? Because the fossil fuel industry has our government, our economy, our culture by the balls.

What can we do? Well, he’s right, ultimately we need assertive public policy. And we need to press relentlessly for the key pieces that are within executive reach – CO2 regs on existing power plants, and an end to government actions – like Keystone permits – that facilitate long-term investments that make the problem unsolvable. And of course we are. And of course we have been, for decades. And we’re getting killed.

Plausible near-term government action is not remotely enough. We need to wrest power back. This often seems impossible, because our economy and our lifestyles are designed to feed the beast at every turn. But the flip side of that realization is that every turn is an opportunity to take a little of our power back, and reduce theirs.

OF FREAKING-COURSE we should address demand. We can do it in our lifestyles. We can do it in state policy, like energy codes. We can do it in community design. We can do it in how we eat. We can do it with our feet. Every damned day. And it’s not just a futile act of individual environmental responsibility. It’s waging freedom.

AND we can stop owning – literally OWNING – this nightmare by divesting. That’s waging freedom too. How much direct damage will we inflict on the industry’s bottom line this way? I don’t know. But we will take back our money and our souls. We’ll draw a line in the sand and make ourselves and others look hard at which side we are on. We’ll make a statement. We’ll activate young people. Those young people will challenge us – most of us alums of these institutions – to choose which side of the line to be on. We will build a stage on which to play out this moral drama, since our legislative bodies have ceased to be such a stage, corrupted as they are by Big Fossil’s money.

And maybe, possibly, conceivably we will build the moral power we need to force our “leaders” and our government to do their job.

If all that sounds hopelessly naïve and “symbolic”, well, shit, given the size of the climate challenge and the scope of any one actor’s ability to change it, you could argue that all actions are “symbolic.” Symbols are powerful. We need power.

Parenti says “I am all for dumping carbon stocks, if for no other reason than a sense of decency and honor. But how is dumping oil stock supposed to hurt the enemy?” Fine. Do it for decency and honor. Isn’t that enough? And if college students all over America and the alums of those institutions simply declare that this is a Fundamental Matter of Decency and Honor – that even if we don’t affect the financial outcome one bit, at least our fingerprints won’t be on this genocidal crime—won’t that be an ENORMOUS change from the bizarre, complacent moral detachment that is our current, collective condition?